Sponsored

No more confusion: Vehicle insurance explained

This guide will help you better understand how vehicle insurance coverage works.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

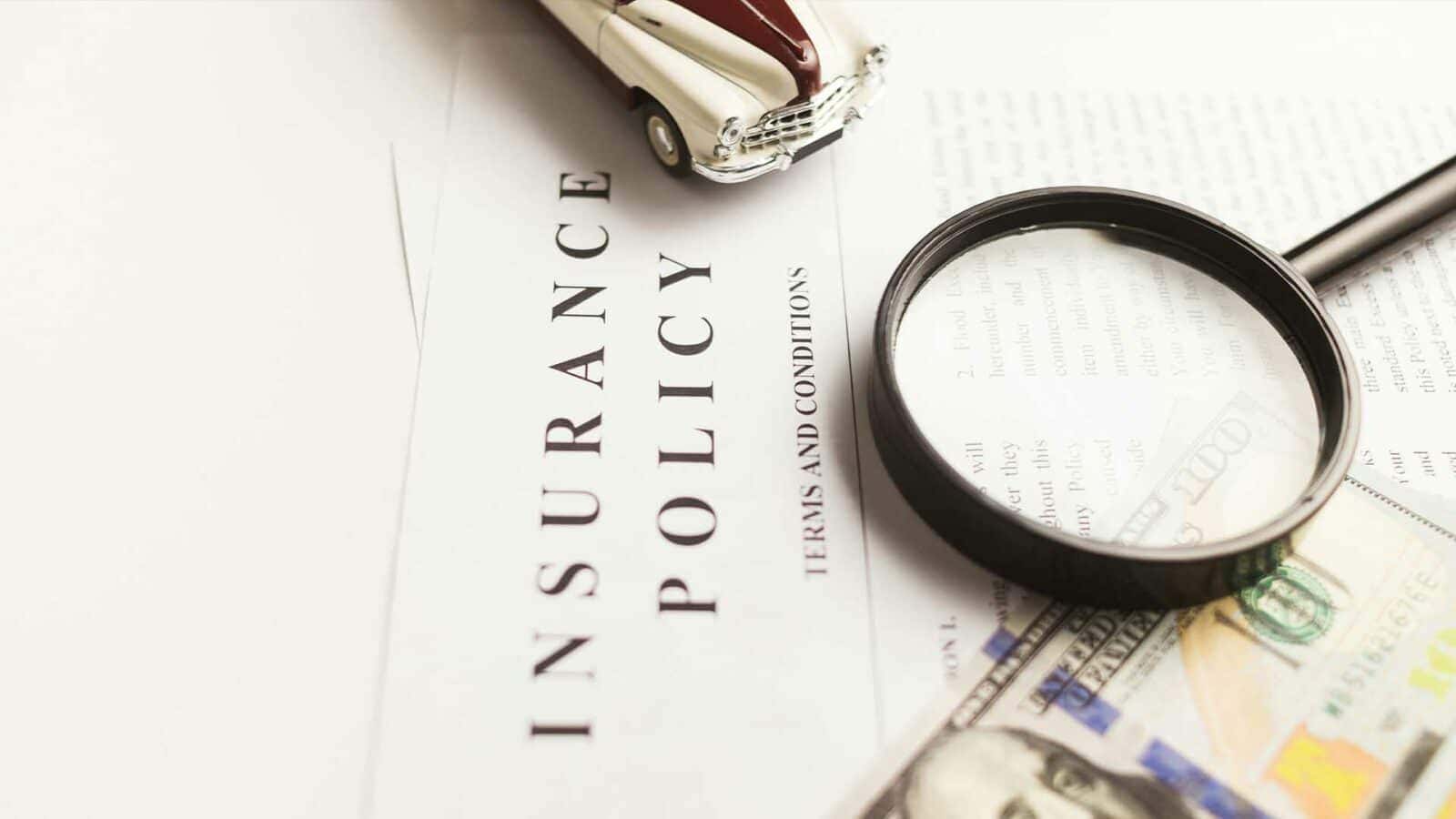

Every vehicle owner has requirements to meet, and the most important one is vehicle insurance.

Companies offer a plethora of insurance policies, but there can be a lot of confusion regarding the same

as there are too many offerings. The key is to choose the policy that suits your budget.

Understanding insurance can be tricky because various types have different benefits and features.

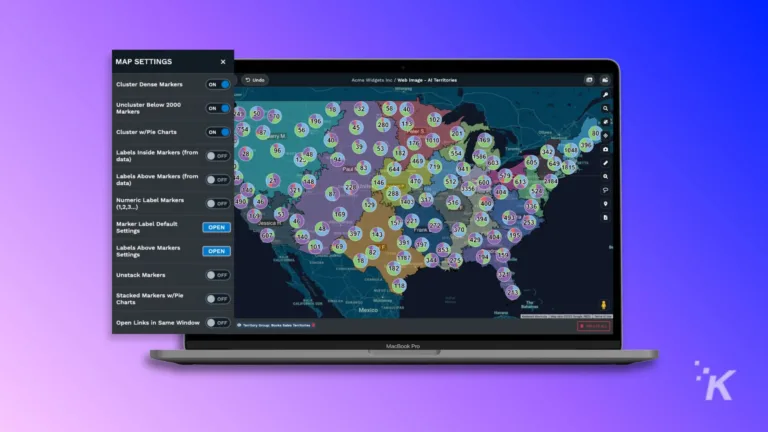

Companies like Panda7 provide financial protection for your vehicle in expected events and help you enjoy your vehicle’s drive fully and worry-free.

An insurance policy safeguards you and your car from all kinds of hassles and ensures your vehicle policy is handled in the best way. Hence, having a firm understanding of the same is essential.

Kinds of vehicle insurance

Insurance companies provide various types of vehicle insurance for you to choose from. Here are some different types to consider:

- Third-party liability: The primary and legally mandated insurance is third-party liability insurance. It covers damages likely to occur against another vehicle, property, or individual. However, this insurance does not cover damage to your car in case of an uncalled-for event.

- Comprehensive: If you are looking for broader coverage, a comprehensive insurance plan is right for you. In addition to the features mentioned above, this insurance covers the damages suffered by your vehicle due to reasons like fire, theft, and natural calamities.

- Special policies and add-ons: The insurance offers collision coverage and additional features like engine cover and zero depreciation. The policy is comprehensive, and you will see various add-ons for your vehicle. You can discuss your needs with the provider based on requirements like pay-as-you-drive and commercial vehicle insurance.

Liability caps

If you and your vehicle are in an accident, there are several things you need to consider.

The payout can be significant, with no maximum limit, for accidents involving injury or death to a third party.

However, there is a limit for damage to third-party property. It’s important to know the specific amount offered by your insurance company.

Tips for extra coverage insurance claims

You should know that when you are involved in an accident with property damage exceeding the policy’s cap, the person concerned is liable to pay the rest.

It’s crucial to understand the limitations of your insurance policy, as the property owner can sue for the amount recovered.

Additionally, ‘umbrella policies’ and ‘excess liability insurance’ are available to provide extra protection beyond regular policy limits.

The process for claiming insurance can be lengthy and varies depending on the provider. Understanding the nature of your claim, whether third-party or comprehensive, is essential, as are the specific guidelines for filing claims.

Third-party insurance claim

The claim steps are as follows:

- The first step is reporting the incident, including contacting the nearest police station and filing the FIR.

- You have to notify the insurance company to provide the details related to the incident.

- You must collect information from the third party, which involves getting their name, contact information, and other details. If there are any witnesses and you can get in touch with them, you should try to do it.

- You must provide the information and other required forms to the insurance company.

- If there are significant damages and insurance, you can take the legal way for representation whenever needed.

Comprehensive insurance claim

You should take the following steps to get such a claim that are mentioned as follows:

- You have to assess the damages of your vehicle. If there is a minor issue, you must decide whether you want a claim. When you have chosen, you have to notify your insurance company for the same.

- Suppose there is theft or significant damage. In that case, you must file an FIR, followed by a collection of all the necessary documents related to the damage and repair bills.

- The company surveyor will inspect the damages for claim verification. After the verification succeeds, the claim will be approved, and you will get the amount to cover the repair costs minus the deductions.

However, if the repair payment has been made, you must submit the bill proof to claim the reimbursement.

Dealing with the claim process can be stressful, but it’s important to trust your insurance company and navigate it confidently.

Final thoughts

Vehicle insurance can be exciting for car enthusiasts but often comes with confusing details. That’s why it’s crucial to clarify the steps for making a claim after damage occurs.

After purchasing your policy, review the details carefully and consider any relevant add-ons. This guide will help you better understand how insurance coverage works.

Have any thoughts on this? Drop us a line below in the comments, or carry the discussion to our Twitter or Facebook.

Editors’ Recommendations:

Disclosure: This is a sponsored post. However, our opinions, reviews, and other editorial content are not influenced by the sponsorship and remain objective.