AI

Meta is spending on AI products more than most

On the Meta’s earnings call, Zuckerberg doubled down, insisting the spending spree was just beginning.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

In the middle of Silicon Valley’s AI gold rush, Meta has decided to go full prospector, only instead of shovels, it’s buying supercomputers and enough data centers to power a small country.

Reports suggest US infrastructure spending could hit $600 billion over the next three years, and Meta’s chunk of that pie is, let’s just say, generous.

But Wall Street isn’t exactly applauding.

When Meta reported its latest earnings this week, investors got a peek at the cost of Mark Zuckerberg’s AI ambitions, a $7 billion bump in operating expenses, and nearly $20 billion poured into capital spending.

All that money went toward building out AI infrastructure and hiring top-tier researchers. The problem? So far, there’s not much revenue to show for it.

On the company’s earnings call, Zuckerberg doubled down, insisting the spending spree was just beginning.

“The right thing to do,” he told analysts, is to “accelerate” AI investment so Meta has the computing muscle it needs for its next wave of “frontier models.”

The company’s about to spend even more money on AI that doesn’t exist yet.

Investors weren’t thrilled. Meta’s stock plunged 12% by week’s end, erasing roughly $200 billion in market value. That’s the kind of drop that makes CFOs reconsider their life choices.

Now, to be clear, Meta’s not exactly broke. The company still cleared $20 billion in profit last quarter.

But this was the first time its aggressive AI spending visibly dented its bottom line. Worse, analysts left the call still wondering: what is all this money for?

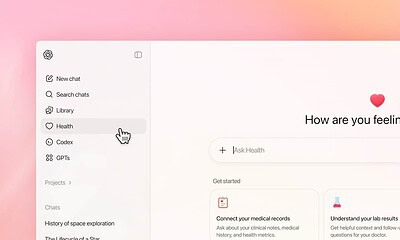

Zuck tried to point to a few bright spots: the Meta AI assistant (apparently with a billion “users,” thanks to being baked into Facebook and Instagram), a buzzy video generator called Vibes, and those new Ray-Ban-style “Vanguard” smart glasses.

But none of these scream “AI revolution” just yet.

In fairness, Meta’s Superintelligence Lab is still new, but investors are losing patience.

Google and Nvidia can point to immediate payoffs for their AI bets. Meta, meanwhile, is asking everyone to trust that a big reveal is “coming soon.”

For now, the only thing scaling faster than Meta’s AI models is its spending, and Wall Street’s skepticism.