Sponsored

Why use buy now, pay later apps in 2024?

Buy Now, Pay Later apps offer a convenient and safe way to defer payments for online purchases, allowing customers to buy products and pay for them within 30 days at no additional cost or interest, making it an ideal option for those in a tight financial situation.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

What do you need for a successful online shopping experience? Of course, besides a great selection of products.

First and foremost, cashless payments allow users to pay quickly, conveniently, easily, and securely. That’s why new innovative payment services, including Buy Now, Pay Later applications, are emerging as the digital space grows.

No matter your industry, BNPL cards are a profitable financial solution for any company and customer.

Firstly, entrepreneurs position themselves and their businesses as mobile and adaptive with convenient payment terms.

Just imagine how convenient and pleasant it is not only to use the payment card but also to provide both the seller and the customer with a reliable solution for payment within a certain time frame after the service is performed, the goods are delivered, etc.

The Rates team will look at situations where deferred payment can be most beneficial and provide tips on using this option wisely.

Financial experts suggest that you should close your Chase savings account, along with any other similar accounts, and consider transitioning to Buy Now, Pay Later tools, highlighting their potential benefits for everyday use.

Definition of Buy Now, Pay Later Apps

“Buy now, pay later” is nothing more than a deferred payment option, which is one of the payment methods in online stores.

This option is often provided by large stores and is offered as an alternative to wire transfers, card payments, or expensive cash on delivery.

It works on elementary principles – a customer buys a product, receives it, checks it out, and even starts using it, and then can pay for it.

When shopping online, have you ever seen buttons on store websites that say “buy now, pay later” or “buy now, pay in 30 days or another financing limits”?

Are you wondering how it works, whether it’s profitable, and whether it’s safe? Check out how to use the deferred payment option and why you should.

Key Features of Buy Now, Pay Later Apps

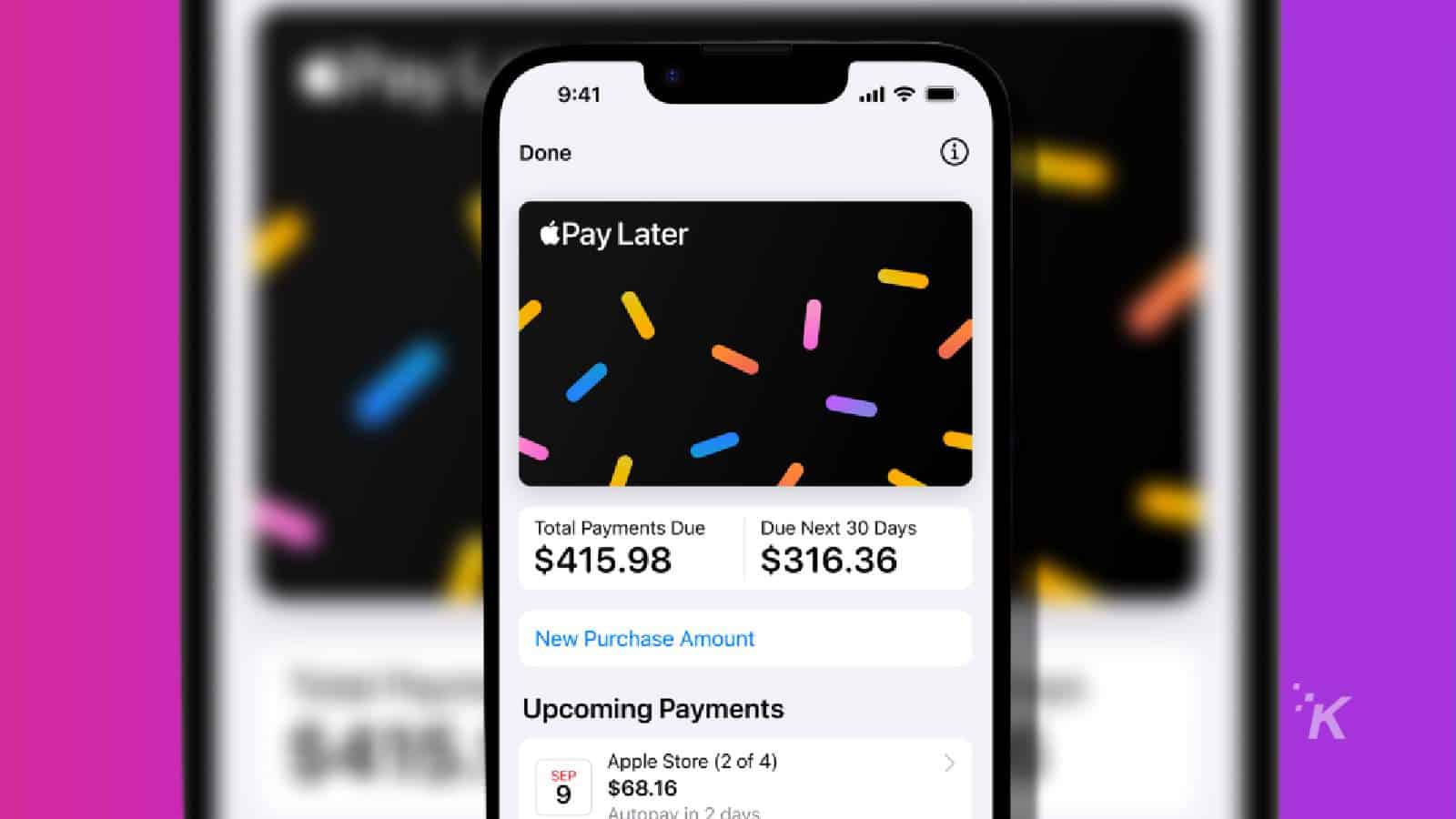

The BNPL solutions offer a deferred payment service that allows customers to buy products online and pay for them within 30 days at no additional cost or interest. How exactly does it work?

A customer completes an order in an online store and chooses after-pay options from the available payment methods. If they don’t already have a BNPL Apps account, they must provide their primary data and accept the transaction with just an SMS code.

The customer has 30 days to pay for their order via BNPL apps at no additional cost or can pay in installments, which means pay in four parts.

The important thing is that when customers receive an order, they can check it and decide whether they want to keep it. If they decide to return the product or part of it, they only pay for the remaining purchases.

Buy now, pay later is a completely safe way to defer payment for orders placed online.

Deferred payment is an alternative to bank transfer or card payment and, most importantly, does not require additional deferral interest rates.

You do not pay a fee, not even 50 dollars, and can pay in installments if necessary. With BNPL apps, you can buy whatever you want, whenever you want, online and get convenient monthly payment terms.

Advantages of the “buy now, pay later” option

Deferred payments are, above all, safe. All transactions are encrypted and confirmed by SMS code only. Therefore, you do not need to provide account or card numbers or log in to the banking credit system.

You only pay for the goods when you receive them, check them out, and decide to keep them. Online payments are also very convenient. It only takes a few clicks to order the products you choose.

But the most important thing is that you don’t spend the money right away – you can pay for your purchases later, for example, after your paycheck, and you have what you need right away.

And all this without the need to go into debt to family, friends, or creditors. You make purchases regardless of your current account balance.

When should I use the deferred payment option?

Deferring online payments is indispensable when, for example, you are in a bad financial situation but still need to make purchases. Then you don’t have to choose what’s more important and give up some of your expenses.

They are also ideal when you don’t want to spend your last money and need to maintain financial liquidity. Then, you can quickly pay for your purchases after your paycheck.

The Buy Now, Pay Later option is also great when you buy products that need to be measured or tested for quality and you’re not sure if you’ll keep them all.

With the deferred payment option, you don’t have to freeze your funds and wait for the seller to refund you in case of a return. You can easily go shopping.

Deferred payments are revolutionizing online shopping. Not only are they safe and convenient, but above all, they allow you to shop wisely and manage your budget correctly.

The Fine Print

Deferred payments require caution and a smart approach to avoid unnecessary costs and fees. The USA and Canada are the most popular countries for these apps.

Global installment of buy now, pay later (BNPL) in domestic e-commerce payments in 41 countries and territories worldwide from 2016 to 2323.

However, if used wisely, these apps can become important tools in financial planning and budget management.

“Buy Now, Pay Later offers new opportunities for consumers, allowing them to access the goods and services they need without stress or financial hardship.

Have any thoughts on this? Drop us a line below in the comments, or carry the discussion to our Twitter or Facebook.

Editors’ Recommendations:

Disclosure: This is a sponsored post. However, our opinions, reviews, and other editorial content are not influenced by the sponsorship and remain objective.