AI

This AI trading coach raised $10M to help you beat the market

This isn’t just another trading app; it’s an intelligent system that learns and adapts in real-time, offering traders the guidance they need to navigate the market’s twists and turns.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

Most people stay away from trading because it feels like a rigged game. While Wall Street firms deploy armies of algorithms and data scientists, regular folks are left guessing which way the market will move next.

True Labs, a company that recently secured $10M in seed funding, wants to change that equation.

The parent company is building two flagship products: True AI, an intelligent LLM that serves as a trading engine, and True Trading, a decentralized trading platform.

Instead of building another trading app with fancy charts, they’re creating something different: an AI that actually learns from every single trade it makes.

“We’re not trying to replace human traders,” says Ben Bilski, co-founder of True Labs. “We’re building an AI coach that learns alongside you, getting smarter with every market move. The goal is to democratize the sophisticated trading tools that have been exclusive to Wall Street for decades.”

How it works

Unlike ChatGPT or other AI models that get trained once and then stay static, True Trading’s system will continuously evolve. Every time someone makes a trade, sends a message, or reacts to market news, the AI absorbs that information and gets smarter.

For example, if the AI misreads a sudden market dip and makes a bad trade, it doesn’t just record the loss—it analyzes every factor behind the mistake, adjusting its future decisions accordingly.

“Every mistake becomes a learning opportunity,” explains Bilski. “Traditional algorithms repeat the same errors because they’re static. Our AI evolves with each trade, building a deeper understanding of market patterns that no single human trader could ever achieve alone.”

Think of it like having a trading mentor who never sleeps, processes thousands of market signals simultaneously, and remembers every mistake it’s ever made.

Because the platform runs on blockchain, every trade and learning update is recorded in the open. That means anyone can audit the AI’s decision-making process, instead of trusting a company to explain it after the fact.

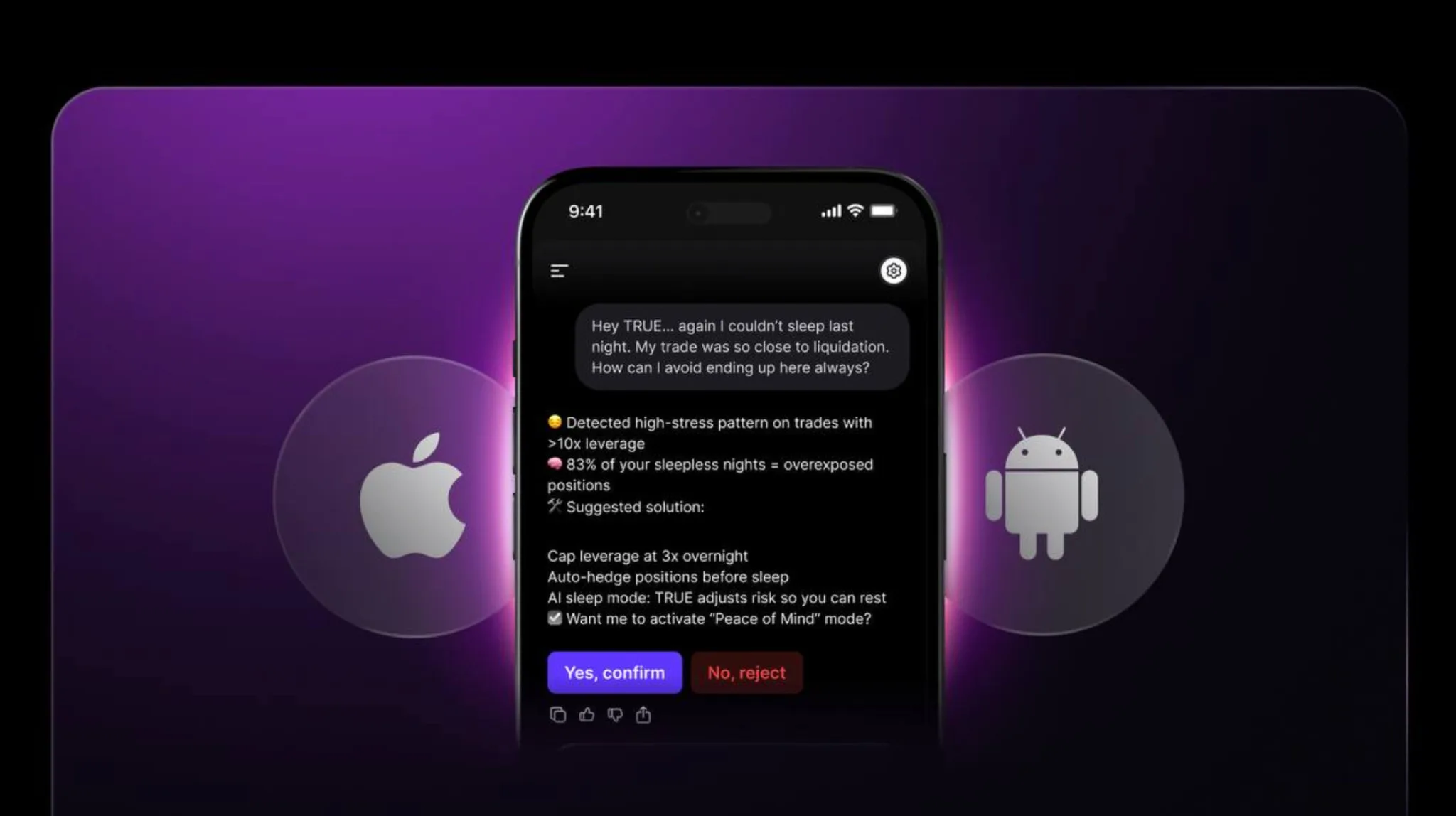

Beyond technical analysis, the AI also functions as a behavioral coach, actively monitoring and intervening when it detects psychological trading pitfalls.

The system tracks patterns like revenge trading (making impulsive trades to recover losses), overexposure (risking too much capital on single positions), and other emotional patterns that typically lead to poor trading decisions.

When these behaviors are detected, the AI provides real-time guidance to help traders step back and make more rational choices.

What makes this different

Most trading algorithms follow pre-programmed rules written by humans months or years ago. True Trading’s approach is more like training a living system that adapts to new market conditions in real-time.

When crypto markets suddenly crash at 3 AM, traditional algorithms often make the same mistakes they were programmed to make. But a learning AI system should theoretically get better at handling these unexpected events each time they happen.

The company says their system will eventually be able to execute trades automatically on behalf of users, though they haven’t announced a specific launch date yet.

The platform also features a copy-trading system where users can follow top traders, who earn rewards for each follower’s transaction.

This creates an ecosystem where successful traders are incentivized to share their strategies, while newer traders can learn by observing and replicating proven approaches.

The bigger picture

If this actually works as promised, it could level the playing field between individual traders and institutional investors who currently dominate markets with sophisticated technology.

Today, hedge funds spend billions building predictive models and buying split-second access to market data—advantages out of reach for most individuals.

But there’s still plenty of skepticism around AI-powered trading. Even the smartest algorithms can’t predict black swan events or sudden regulatory changes that can tank entire sectors overnight.

True Trading hasn’t shared performance data yet since the platform is still in development. The real test will be whether their learning AI can actually deliver consistent returns when real money is on the line.

It’s a bold experiment. If True Trading can pull it off, it could change the way everyone—from hobbyists to professionals—thinks about trading.

“The traditional trading world has been dominated by institutions with massive resources,” reflects Bilski. “Our vision is to create an AI that levels the playing field—one that learns from collective market intelligence and shares that knowledge with everyone. It’s about democratizing access to sophisticated trading insights that were previously available only to the elite.” The platform launches in 2026.

True Trading’s vision of democratizing Wall Street-level AI tools sounds promising, but will it actually deliver? Drop your thoughts in the comments below or join the conversation on our Facebook and Twitter – especially if you’re already trading or thinking about getting started.