Apps

Incogni vs. Aura: Which privacy protection service works better?

Wave goodbye to data exposure! Incogni is your go-to for automated data removal from brokers, while Aura delivers a comprehensive digital security suite.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

Your personal data is almost literally everywhere online – from marketing lists and credit bureaus to background-check sites, e-commerce websites, and social platforms.

Every new account or purchase you make adds another information to your digital profile, making it easier for companies to track and target you. This leads to profiling, spam, unwanted calls, or even fraud and identity theft.

If you’ve decided to take care of the issue, you’ve likely come across Incogni and Aura during your research. Both providers aim to protect your privacy, but, of course, they’re not the same.

Aura offers a broader identity protection package, while Incogni focuses on what it’s doing best – removing your personal information from data brokers, who are the source of much of that exposure.

Below, we compare both services head-to-head on coverage, automation, transparency, pricing, and ease of use, to help you make the best choice.

At a glance: Incogni vs. Aura

| Incogni | Aura | |

| Price | From $7.99/month | From $12.00 |

| Core focus | Automated data broker removals | All-in-one identity theft & credit protection |

| Automation Level | Fully automated, recurring removals | Partly automated; user confirms actions |

| Broker Coverage | 420+ public & private brokers | Limited data broker opt-outs (focus on identity theft alerts) |

| Additional Tools | Data removal, exposure tracking | Credit monitoring, VPN, antivirus, parental controls |

| Verification | Deloitte Independent Limited Assurance Assessment | None |

| Support | Email, live chat for subscribers, phone support for Unlimited subscribers | 24/7 phone, email, live chat |

| Best For | Hands-off, recurring data removals | Families seeking a full identity-protection bundle |

How each service approaches privacy protection

At first glance, it may seem like Incogni and Aura solve the same problem and keep your data safe online. In truth, though, they offer different sets of services and tools.

Incogni was designed to remove your personal information from data brokers and make sure it stays that way.

Once you authorize it, Incogni sends out opt-out requests to hundreds of brokers, both private and public, tracks responses, and resubmits requests to keep data from reappearing.

It’s a fully automated, recurring removal system that you don’t have to think about too much when it works for you.

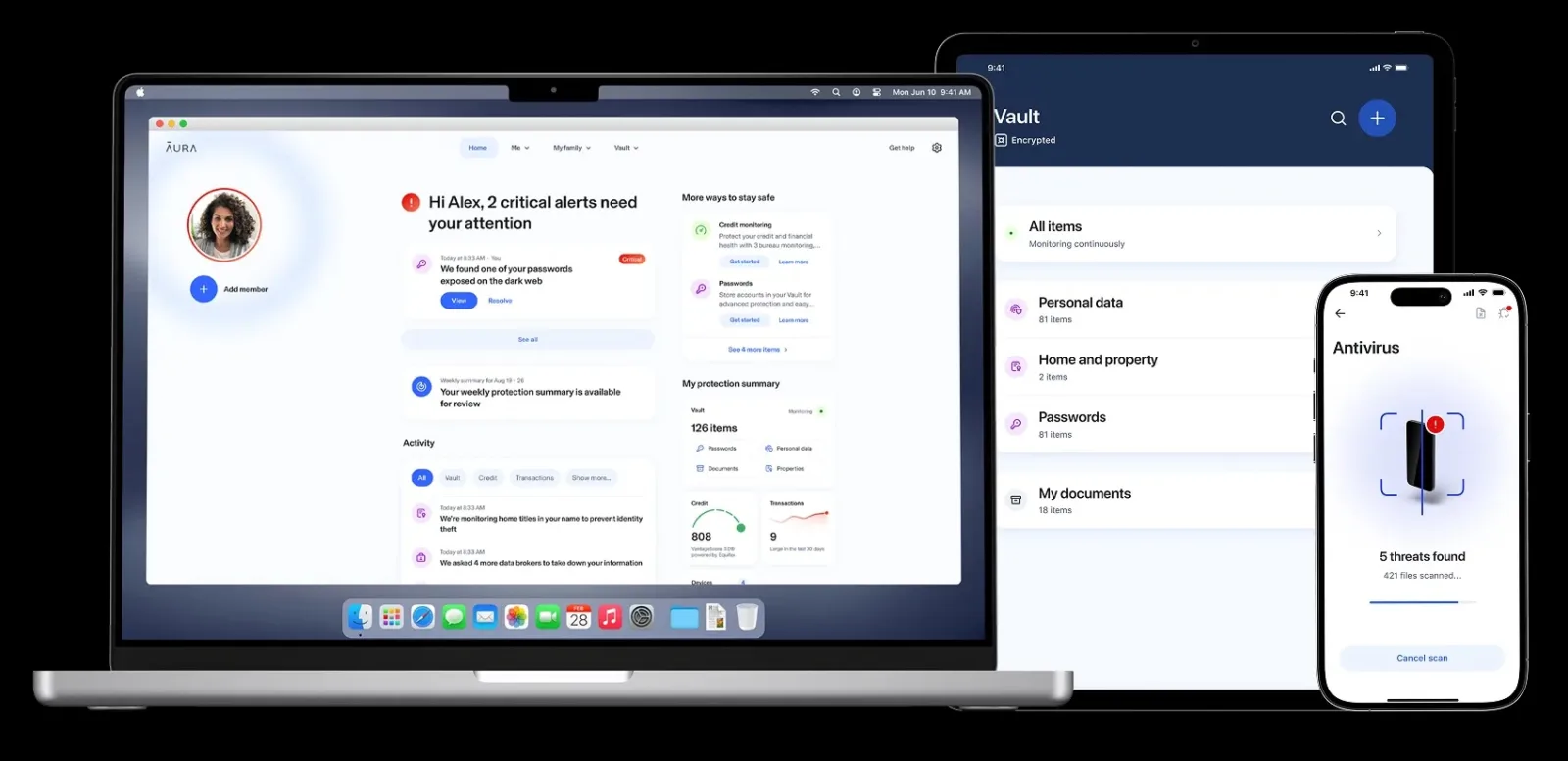

Aura, meanwhile, tries to focus on a much bigger picture. It offers credit monitoring, antivirus, VPN, password management, and identity theft insurance.

Data removal, the main focus of Incogni, is just a part of its suite. As such, due to its complexity, users often need to engage to approve or confirm opt-outs manually.

What’s more, coverage is mostly limited to public people-search brokers rather than private data aggregators.

In short, Aura protects your identity, Incogni protects your data itself.

Coverage and effectiveness

Here is where the biggest distinction lies.

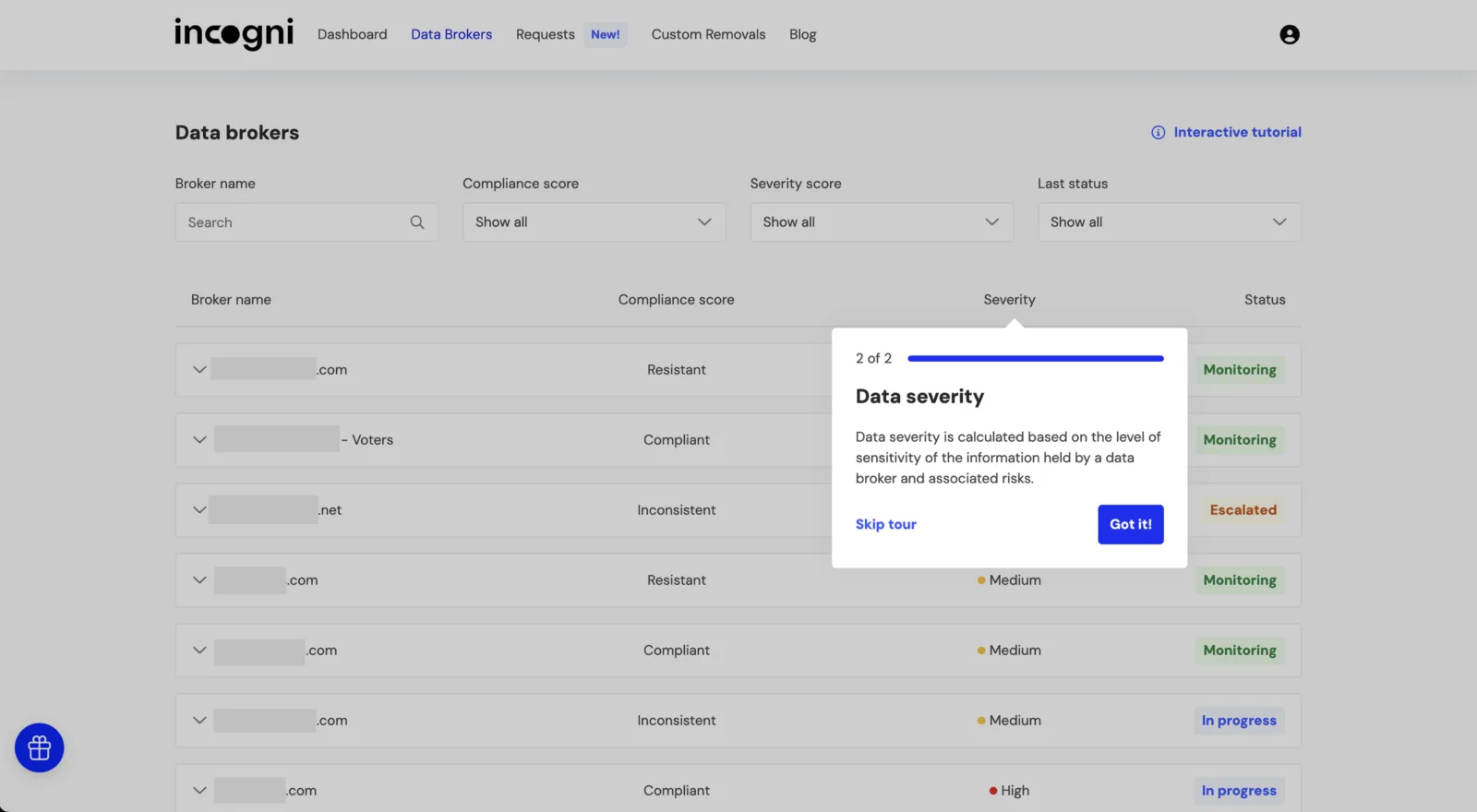

Incogni covers 420+ brokers, both public and private sectors: marketing, recruitment, risk-assessment, and finance. That deeper coverage goes to the source, which may actually, with time, reduce spam, scams, and profiling.

Aura’s reach is much narrower, primarily focusing on visible people-search sites, i.e., those that appear in regular search results.

It’s true, though, that it compensates with a lot broader digital-safety offer like breach monitoring and antivirus tools, but those won’t remove your personal information from broker databases.

So, if your main concern is data exposure, Incogni’s broker coverage will certainly deliver better results.

Transparency and verification

Reasonably, both companies prioritize user trust, but they approach transparency differently.

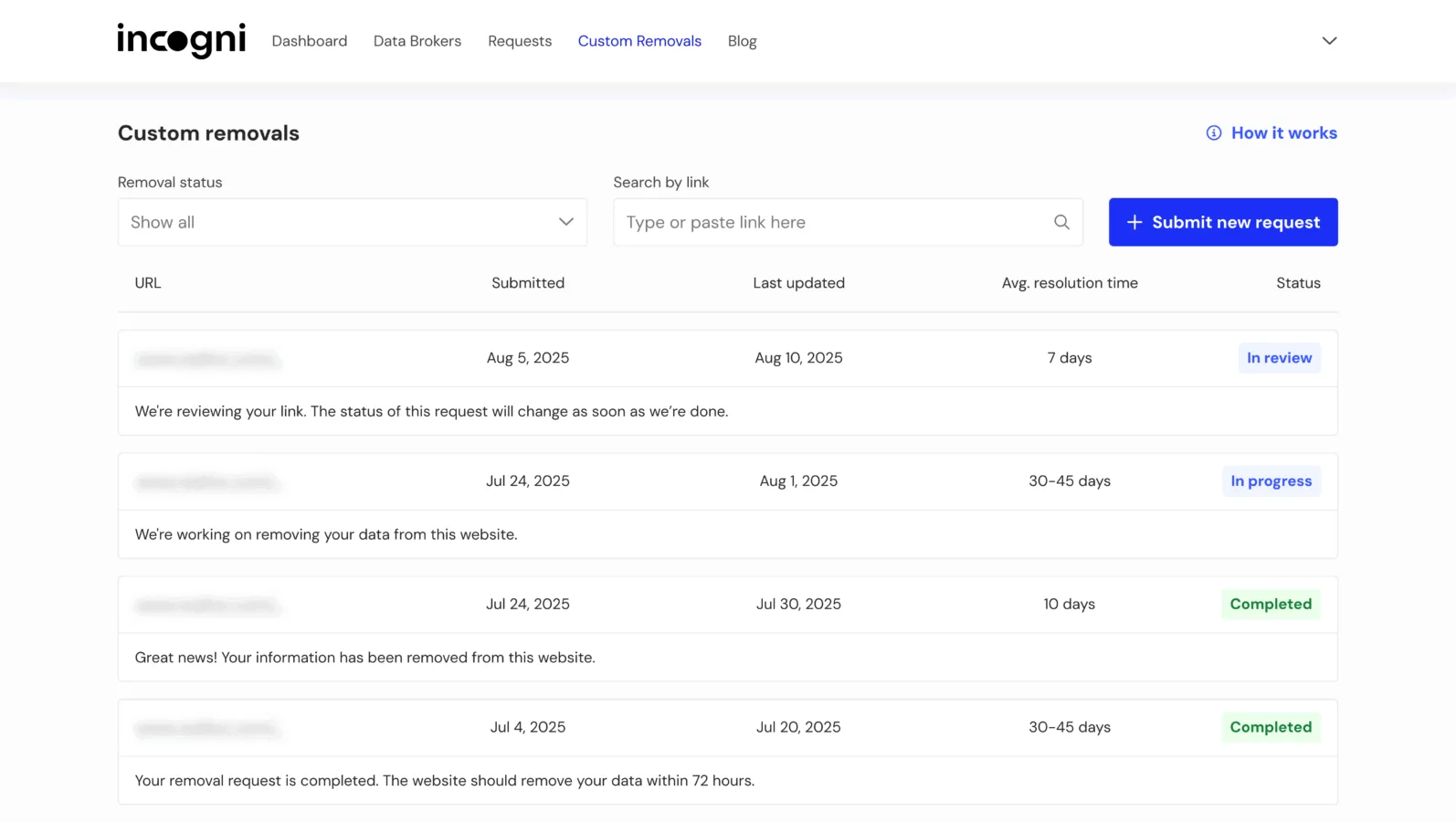

Incogni’s users have access to a real-time dashboard that displays brokers who have been contacted, confirmed deletions, and removal cycles.

What’s important, this process has been independently checked through a Deloitte Limited Assurance Assessment, making Incogni probably the only provider that can boast this.

Aura, on the other hand, focuses its transparency on credit and identity alerts: users receive notifications about any occurring breaches, suspicious activity, or compromised credentials.

However, its data removal feature doesn’t offer the same visibility or third-party verification.

So while Aura tells you what went wrong, Incogni focuses on making sure it doesn’t happen in the first place.

Pricing and plans

Incogni keeps things simple: one subscription includes all its core features, i.e., automated removals, custom requests, and access to private and public broker networks.

Prices start at $7.99/month (annualized). There are, of course, more expensive plans, but the essentials for keeping your personal data safe are included in the most basic subscription.

With Aura, it’s a little different:

- Individual: from $12/month (annualized)

- Couple: from $22/month (annualized)

- Family: from $32/month (annualized)

Each plan includes identity theft insurance, VPN, password manager, and antivirus protection.

All these tools justify the price and come as a good deal if you need a complete security suite, but if you’re only after data removal, much of that money will go toward features you may never use.

Ease of use and everyday experience

It’s right to admit that both providers design their tools with user experience in mind. However, their platforms aren’t, of course, the same.

With Incogni, setup takes just a few minutes: you verify your identity, and the system starts removing your data from the web automatically. You can log in at any time to see what’s happening, but you don’t have to do anything.

Aura, on the other hand, as it offers more features and tools, also requires more interaction. It regularly sends notifications about new alerts, breaches, and any activity on their accounts.

It’s highly informative, but it means it also demands more ongoing attention.

If you prefer a “set-and-forget” system, Incogni is better. If you like dashboards full of activity and alerts, Aura provides that, though much of it requires your response.

Strengths and limitations

Incogni

| Pros | Cons |

| Fully automated data removals | Phone support only for Unlimited subscribers |

| Covers 420+ public and private brokers | Requires subscription from the start (no free tier) |

| Deloitte-assured transparency | Limited to data privacy |

| Simple pricing, no upsells |

Aura

| Pros | Cons |

| Comprehensive digital-security suite | Limited broker coverage and fewer automated removals |

| Credit, identity, and breach monitoring | More expensive for data removal alone |

| 24/7 support with phone access | Can feel overwhelming for users who only want removals |

| Suitable for families and multi-user households |

Who each service is best for

| If you’re someone who… | Choose Incogni if… | Choose Aura if… |

| Wants to stop personal data from spreading | You want automated data removals from hundreds of brokers | You’re mostly worried about identity theft and breaches |

| Prefers minimal involvement | You want to set it and forget it | You don’t mind reviewing frequent alerts |

| Wants affordability and focus | You want one price for all essential removals | You need multiple family protections |

| Needs an all-in-one suite | You’re fine pairing it with your existing tools | You want VPN, antivirus, and insurance in one place |

Haven’t found the answer you are looking for? Check our list of the best data broker removal services, with Aura and Incogni, among others.

Final verdict: Specialized protection vs. all-in-one security

Aura offers an impressive set of features – credit alerts, VPN, password management, and identity-theft insurance – making it a great choice for users who seek an all-in-one security tool.

However, its data-removal feature is limited and requires manual intervention, which means that your personal information may still get traded by private brokers.

Incogni, conversely, is far more focused: it specializes in automated, recurring data removals from both public and private brokers.

It’s independently assured, affordable, and designed to work quietly in the background without bothering you.

If your goal is to prevent your data from being traded, Incogni offers deeper, longer-lasting defense.

Aura is still a great fit if you need broader digital security. But for targeted data removal and ongoing protection, Incogni wins on focus, automation, and simplicity.

Incogni offers fully automated personal data removal from 420+ data brokers, uniquely targeting both public and private sources that drive spam, profiling, and identity fraud. The service handles everything from initial removal requests to ongoing monitoring.