Apps

Now that Simple’s online banking service is shutting down, here are 5 of the best alternatives

RIP Simple.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

After many years in operation, the popular online banking service Simple is shutting down. Though customers were informed that their accounts would stay intact and be transferred to Simple’s parent company, people started looking for alternative services. If that’s you, here are the five best alternatives to Simple’s online banking service.

BBVA

First and foremost, there’s the option of not looking for an alternative and just sticking with your current Simple account. Every customer with a Simple account will be able to keep it as the company will transfer it to Simple’s parent company BBVA. If you decide to stick with this option, you won’t have to go through the tedious process of finding an alternative and setting up an entirely new account. That is if you were a Simple client in the first place.

The great news is that BBVA lets you have an online checking account with absolutely no monthly service fees. You will be able to access over 64 thousand free ATMs while having an account that doesn’t pay any interest. The current national average of APY for saving account interest rates is 0.05%, but BBVA’s online savings account comes with only a 0.01% APY. Unfortunately, there is a downside to sticking with BBVA. However, it is a relatively insignificant one: BBVA has branches in a limited number of states, including California, Florida, Texas, Colorado, Alabama, New Mexico, and Arizona.

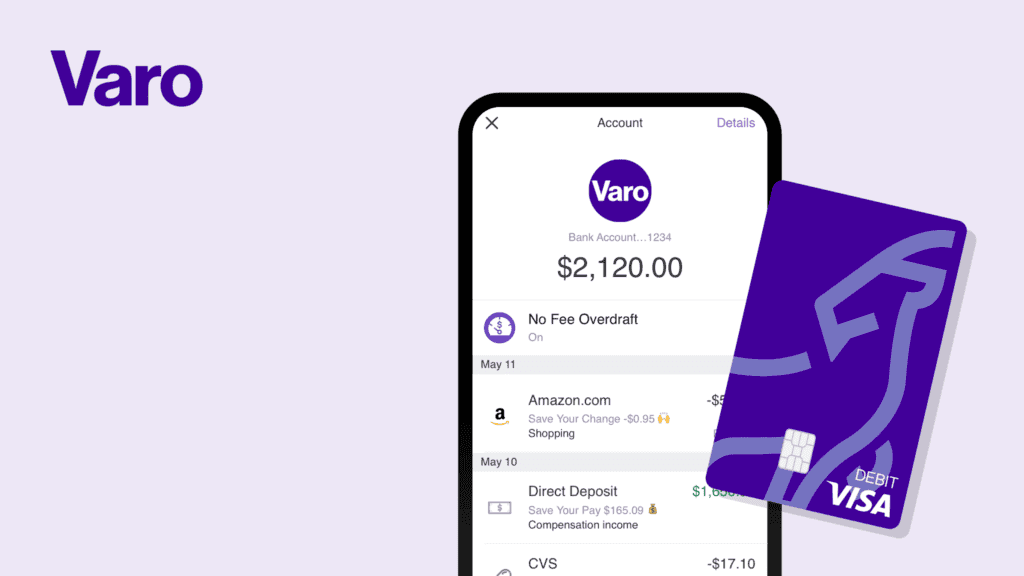

Varo

If you do decide to change your service, Varo can be a good starting point. Varo opens both checking and savings accounts – and both of them are free. It has a pretty big ATM network for withdrawals, making it easier to access your money almost anywhere. Varo only allows cash deposits at Green Dot locations with a fee attached.

As Charles Slater from the paper writing services review site Best Writers Online says, “Varo is a great option for those looking for something simple. It’s easy to get the hang of how to use Varo, which is why it has become so popular.”

Varo doesn’t have any foreign transaction fees for checking accounts, allowing customers to get their paychecks up to two days earlier. Its savings account has an APY of up to 2.80% on balances up to $10,000 if certain conditions are met (and if they aren’t, the APY is 0.40%). Moreover, Varo also has the invaluable “Save Your Pay” and “Save Your Change” features that encourage customers to set aside their money and save some later regularly.

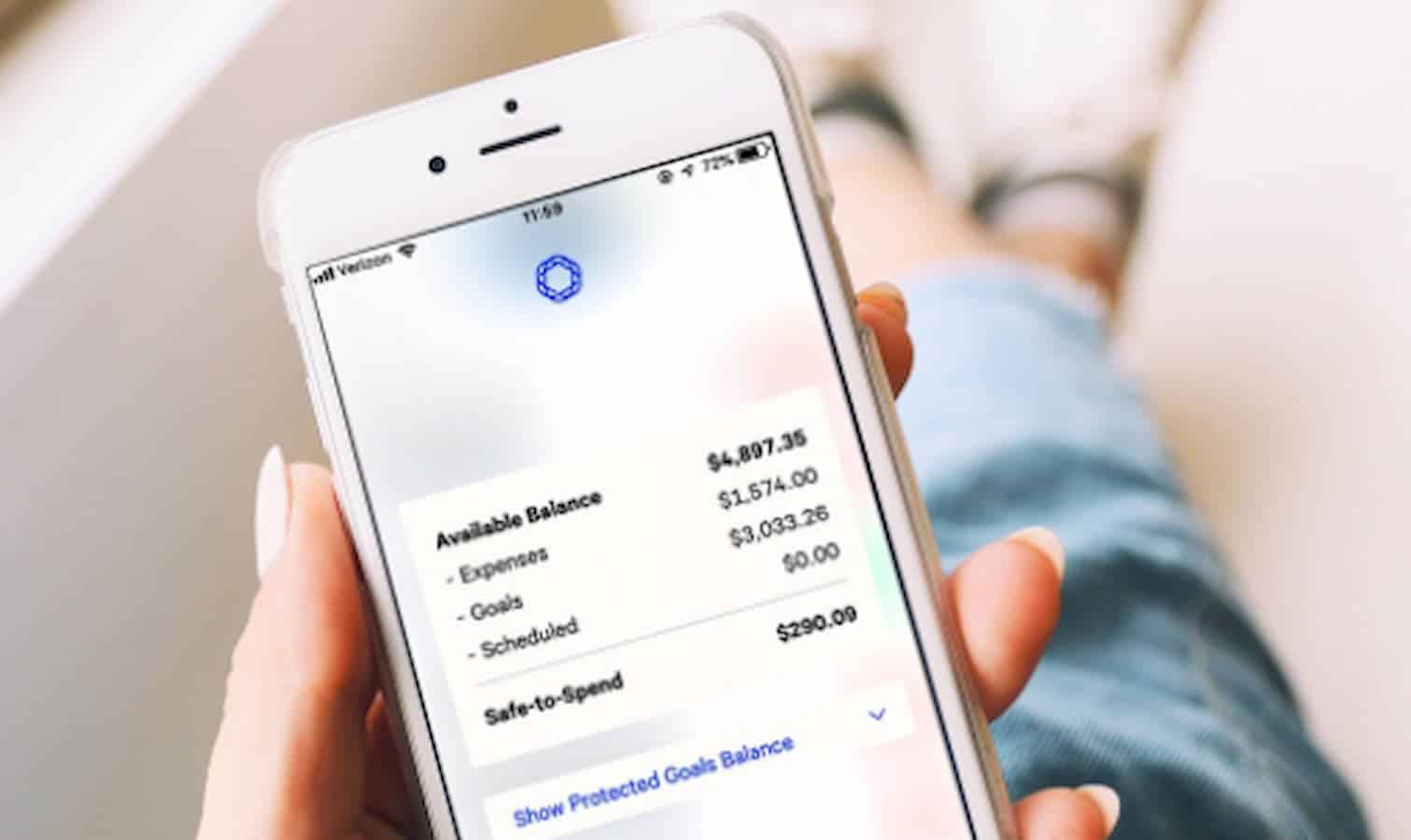

Chime

Another great alternative to try is Chime. Chime has often been compared to Varo as they have similar features and are both quite popular. Much like Varo, Chime accepts cash deposits only from third-party Green Dot locations with a fee attached. But other than this small detail, most of Chime’s features and options are quite customer-friendly.

Chime has no monthly fees on its Spending and High Yield Savings accounts. In addition to that, the savings account offers a 0.50% APY. Like Varo, Chime lets its customers receive their paychecks up to two days earlier, which isn’t a feature banks commonly offer. If this is important for you, then either Varo or Chime will be an excellent alternative for you to try.

Customers are also encouraged to use the two optional features for more significant savings. The first feature lets customers round up (to the nearest dollar) every purchase made with the Chime debit card and then deposit the difference into the customer’s savings account. The second feature lets customers automatically transfer 10% of their paycheck into their savings account.

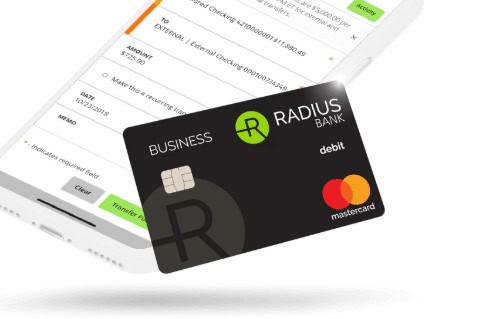

Radius Bank

Unlike Varo and Chime, Radius is an online-only bank that offers tiered interest rates. It also has no monthly fees on both its Rewards Checking and savings accounts. Of course, that is only applied if customers maintain certain balances, but it still an important attribute valued by many clients.

As Laura Sheen from the writing services review site Online Writers Rating puts it, “ Radius has gained a good reputation and more people are opening accounts in it even though it is an online-only bank which is not something everyone can accept right away.”

Radius offers a 0.10% APY for balances over $2,500 with a 0.15% APY for balances over $100,000. Its Rewards Checking account lets customers earn an unlimited 1% cashback applied to online and signature-based “credit” transactions made with the Radius debit card. Moreover, customers get access to unlimited automatic ATM fee rebates.

Personal Capital Cash

Last but not least, you can consider using Personal Cash – though this might not be an option for everyone. There is a hybrid of savings and checking accounts called cash management accounts that have become more popular in recent years. Such accounts are usually offered by non-bank financial service providers such as brokerages.

To put it simply, the cash management account from Personal Cash is an automated investment management service that has tools that customers can use for budgeting and tracking their net worth online. This, of course, has created a very good reputation for Personal Cash which now gets good user reviews on such platforms as Apple App Store and Google Play Store.

However, the downside of having a cash management account is that you won’t be able to get a debit card and make cash withdrawals or deposits. This is because Personal Capital Cash can only move money in and out of the account via electronic transfer rather than physical means. On the other hand, you can link your account to a separate external checking account for paying your bills and performing other similar actions.

Final Thoughts

To sum up, there are definitely some great alternatives to the online banking service Simple, so if you want to try something new, you should check out one of the options listed in this article.

Did we miss any? Have any thoughts on this? Let us know down below in the comments or carry the discussion over to our Twitter or Facebook.

Editors’ Recommendations:

- Stilt has a new banking service meant to help immigrants moving to the US

- T-Mobile finally launches its new banking service, T-Mobile Money

- T-Mobile is launching a mobile banking service called Money

- There’s almost $150 billion worth of Bitcoin out there that can’t be accessed by anyone

Editor’s Note: Melissa Mauro is a self-improvement author who is always interested in new projects. She wants to create her own writer brand, that’s why Melissa is looking for fresh platforms for the implementation of her ideas. Creativity and unique style make it possible to deliver valuable and engaging content to her ideal reader.