Sponsored

PayPal joins the crypto game: What to know

PayPal has become the first major US fintech firm to launch its own cryptocurrency token, a stablecoin named PayPal USD (PYUSD), pegged to the US dollar.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

In a significant move, PayPal has become the first big US fintech company to introduce its own cryptocurrency token, a dollar-pegged stablecoin named PayPal USD (PYUSD).

This foray into the crowded stablecoin market comes with bold promises of revolutionizing money transfers among the vast community of investors into crypto.

Although the cryptocurrency hype has subsided, with prices remaining relatively stable since 2022, PayPal’s Chief crypto executive believes the timing is right and that the company holds a competitive edge.

PayPal crypto advantages

Jose Fernandez da Ponte, PayPal’s Senior Vice President and General Manager of blockchain, crypto, and digital currencies, asserts that stablecoins are currently the most compelling application for blockchains.

He highlights the advantages of stability, programmability, and quicker settlement times, emphasizing the growing market demand for new market entries that aren’t only fully backed but also fully regulated, setting them apart from existing options like Tether.

Addressing concerns raised by a Bloomberg report suggesting a pause in stablecoin development, da Ponte clarifies that this isn’t accurate.

The regulatory pressures faced by PayPal’s partner, Paxos Trust, over its relationship with the platform Binance played a role in creating this perception.

However, the PayPal crypto commitment to the stablecoin project remained unwavering, dispelling any doubts about its dedication. The backdrop against which PayPal is launching its stablecoin is fraught with challenges.

Over the past year and a half, crypto liquidity has diminished, and the collapse of significant banks, including those friendly to the crypto market, has caused ripple effects in the stablecoin market.

Additionally, regulatory scrutiny from the SEC has impacted the sector’s growth. Da Ponte, however, sees these challenges as precisely the opportunity for PayPal’s success.

The company’s extensive infrastructure, spanning regulatory compliance, risk management, and global reach, gives it an advantage in navigating this complex landscape.

Stablecoins

Stablecoins, as a subset of crypto, offer a dependable means to maintain a consistent value, often pegged to a real-world asset like a fiat currency.

The allure of using stablecoins, particularly those pegged to the US dollar, lies in their ease of use and quick cross-border settlement, especially compared to traditional fiat-based transactions.

They provide an alternative payment network built on top of the commercial bank system, offering transparency and interoperability.

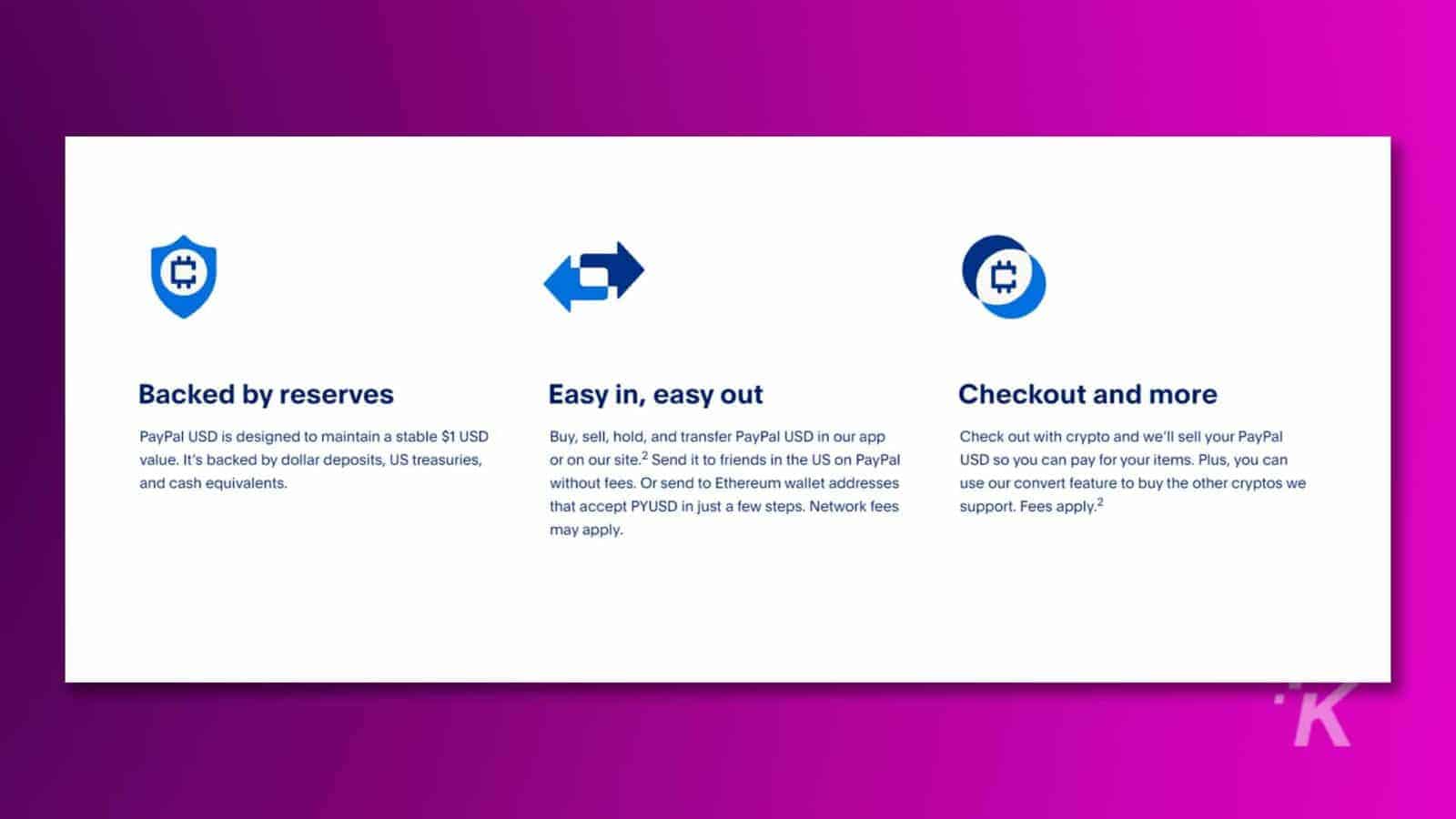

PayPal’s PYUSD stablecoin, backed by a mix of dollar deposits and short-term US Treasuries, offers a bridge between fiat and the web3 space.

Da Ponte emphasizes that the company’s vast user base, including both consumers and merchants, positions PayPal crypto well to drive adoption and accessibility.

While the stablecoin market is competitive, the PayPal crypto offering sets itself apart by leveraging its massive user base and fiat connectivity.

The company’s emphasis on interoperability and on-chain transfers bolsters its value proposition, enabling users to move PYUSD seamlessly between wallets, both within and outside the PayPal ecosystem.

Challenges

PayPal’s launch of PYUSD isn’t without challenges, with the initial rollout limited to US customers. However, da Ponte remains confident in PayPal’s ability to overcome hurdles, given its established reputation, compliance framework, and infrastructure.

The stablecoin space, despite its complexities, presents significant potential. As traditional players like PayPal crypto venture into this domain, it signals a broader shift toward embracing stablecoins for their efficiency and utility.

While challenges remain, the growing institutional interest and evolving regulatory landscape set the stage for PayPal crypto to capitalize on its strategic entry into the stablecoin market.

Editor’s Note: Ronn Torossian is the Founder and Chairman of 5WPR, a leading PR agency.

Have any thoughts on this? Drop us a line below in the comments, or carry the discussion to our Twitter or Facebook.

Editors’ Recommendations:

- Are influencers influential for technology brands?

- Crisis management strategies in the digital age

- Public relations strategy for a new crypto protocol

- Why is digital PR important?

Disclosure: This is a sponsored post. However, our opinions, reviews, and other editorial content are not influenced by the sponsorship and remain objective.