Sponsored

Building credit from scratch? How monitoring tools can accelerate your progress

Credit monitoring tools are your new best friend, offering real-time alerts, breaking down score factors, and showing you how your actions shape your financial future.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

Starting your credit journey from scratch can feel overwhelming. There’s a lot to learn, and the financial world doesn’t exactly roll out a red carpet for newcomers.

Lenders and landlords look at your credit history to decide if you’re trustworthy, but if you don’t have one, where do you even begin?

The good news is that there are smart tools that can help guide you through the process.

Credit monitoring tools, in particular, can make a real difference by keeping your progress visible, helping you spot issues early, and giving you insights that help you grow faster.

1. Understanding the Importance of Credit

Your credit score is more than just a number; it’s a reflection of your financial trustworthiness. Whether you want to rent an apartment, finance a car, or get approved for a credit card, your score matters.

When you’re starting with no credit history, you have a blank slate. That means lenders can’t judge your ability to manage debt.

Establishing credit early and managing it responsibly opens doors. It shows that you can handle financial obligations and gives lenders a reason to trust you.

Without credit, you may face higher interest rates, security deposits, or even outright rejections.

2. First Steps Toward Building Credit

One of the first things you can do to start building credit is apply for a secured credit card. These cards require a small deposit that becomes your credit limit.

Using the card for small purchases and paying off the balance in full each month shows that you can borrow responsibly.

Another great option is becoming an authorized user on someone else’s credit card. Their responsible use can benefit your credit report if they have a solid payment history. In the early stages, consistency matters more than anything else.

This is also where credit monitoring services can give you a valuable edge by tracking your progress and alerting you to any changes or red flags.

3. Why Monitoring Matters When You’re Just Starting Out

Even small changes can have a big impact when you’re new to credit. Monitoring tools closely monitor your score, helping you understand what affects it and how you can improve.

These tools break down the factors influencing your score, such as payment history, credit utilization, and length of credit history.

If your score drops suddenly, you’ll know why and can take action immediately.

Regular updates help you stay focused and motivated. It’s like having a coach in your corner, showing you the direct results of your efforts and nudging you toward smarter habits.

4. Spotting Errors Before They Hurt You

It’s surprisingly common to find errors on your credit report, even for people with a short credit history.

A wrong account, a payment marked late when it wasn’t, or a mistaken address can all pull your score down.

When you catch these mistakes early, you can dispute them and protect your progress. Monitoring tools make this process a lot easier by notifying you when changes occur.

Instead of checking your credit report manually every few months, you get real-time alerts. This gives you peace of mind and ensures your hard work isn’t undone by someone else’s error or outdated info.

5. Setting Realistic Credit Goals and Tracking Them

Everyone wants an 800 credit score, but getting there takes time and patience. Setting realistic milestones—like reaching a score of 650 in six months—can help you stay focused and encouraged.

Monitoring tools provide charts and data that show how your actions affect your score. Did your score rise after paying down your balance? You’ll see it. Did it drop because of a hard inquiry?

You’ll see that too. These insights help you adjust your strategy in real-time. It’s not just about building credit—it’s about building the right habits that lead to long-term financial health.

6. Learning From Patterns and Trends in Your Credit Behavior

Every action you take with credit creates a pattern. Maybe you always pay on time but carry high balances, or maybe you’re great at keeping low balances but forget due dates.

Monitoring tools help you spot these trends. They show you how your habits influence your credit score month after month.

When you review these patterns, you learn what works and what doesn’t. This reflection allows you to shift your habits for better results.

For example, if your credit utilization spikes at the end of every month, you might decide to make multiple payments to keep it lower.

7. Protecting Yourself From Identity Theft and Fraud

When you’re building credit, identity theft can be a massive setback. Someone opening a fraudulent account in your name can destroy your credit before you even get a chance to build it.

Monitoring tools offer early warnings. If a new account is opened or a hard inquiry appears unexpectedly, you get notified right away.

Quick action makes a big difference—you can freeze your credit, report the fraud, and begin damage control immediately.

This kind of protection is critical when every point on your credit score counts. Think of monitoring as a security system guarding your financial progress.

8. Staying Motivated Through Visual Progress

Credit building is a slow process, and it’s easy to feel discouraged. You might do everything right for months before seeing real movement in your score.

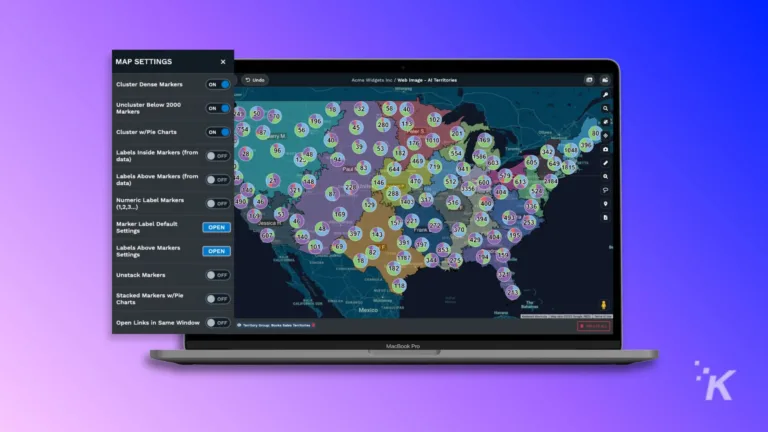

That’s where visual tools come in. Monitoring platforms often display graphs, score timelines, and milestone markers that help you see the long game.

Watching your score inch upward over time can be surprisingly motivating. It’s like watching your savings grow—small gains add up.

These visuals make the journey feel more real and less abstract. Instead of guessing, you’re tracking. And tracking turns small wins into powerful motivation.

Building credit from scratch takes time, but with the right tools, you can speed up the process and stay on track. Monitoring tools do more than watch your score—they teach you how to improve it.

They catch mistakes, alert you to risks, and show you how your habits affect your financial future. By using them consistently, you turn guesswork into strategy.

You gain confidence, protect your progress, and build credit with clarity and control. Whether you’re just starting out or aiming for the next level, smart monitoring can be the edge that keeps you one step ahead.

Building credit from scratch can be tough, but you’re not alone! Have you tried credit monitoring tools? Did they help, or not so much? Share your experiences, tips, or questions in the comments below.

Editors’ Recommendations:

Disclosure: This is a sponsored post. However, our opinions, reviews, and other editorial content are not influenced by the sponsorship and remain objective.