Crypto

Impacts of bitcoin trading on the World’s economy

Increasing the use of cryptocurrency could affect global trading, inflation, stock market volatility, and so on.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

The Bitcoin phenomenon has been one of the most talked-about topics over the past few years. The cryptocurrency has seen tremendous growth in terms of both value and popularity, with more and more people investing in it.

While there are many benefits to Bitcoin trading, there are also some potential downsides that you should be aware of. Bitcode Prime is one of the best platforms you can use to gain guidelines about bitcoin trading.

Bitcoin – Not all good and not all evil

One of the biggest impacts of Bitcoin trading on the world economy is its effect on inflation. If more and more people start using Bitcoin as a currency, it could lead to higher inflation rates.

There would be more demand for goods and services, but the supply would remain the same. This could lead to prices rising and affecting the purchasing power of consumers around the world.

Another potential impact of Bitcoin trading is its effect on global trade. If Bitcoin becomes a more widely-used currency, it could potentially replace traditional currencies in some international transactions.

This could lead to different countries using different currencies and could make it more difficult to conduct trade between them.

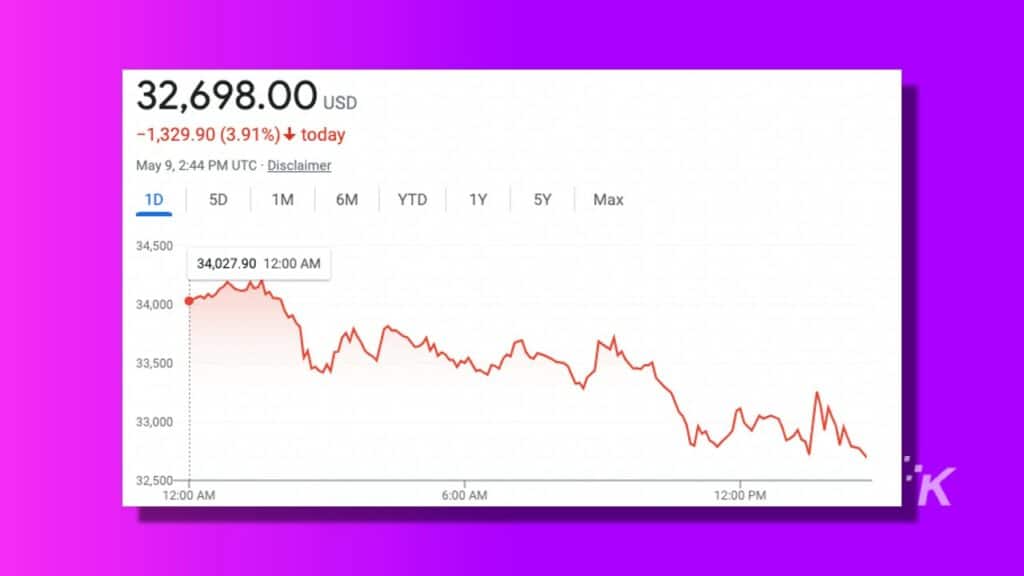

The volatility of Bitcoin prices could also impact the world economy. The price of Bitcoin has been known to fluctuate quite a bit, this could lead to economic instability in some countries if their currency is linked to the value of Bitcoin.

Overall, the potential impacts of Bitcoin trading on the world economy are both positive and negative. It is important to consider these factors before investing in Bitcoin or any other cryptocurrency.

The world’s economy has been growing more and more unstable in recent years. Many experts believe that the instabilities directly result from the increasing popularity of Bitcoin and other cryptocurrencies.

Bitcoin is often seen as a way to shelter yourself from economic turmoil, as it is not subject to the same rules and regulations as traditional fiat currencies.

This has led to an influx of investment into Bitcoin, which has caused its price to skyrocket. While some see this as a good thing, others worry about the potential impacts Bitcoin trading could have on the world’s economy.

Bitcoin trading could impact the world’s economy in a few key ways. First, if more people invest in Bitcoin, it could decrease investment in traditional fiat currencies.

This could cause the value of fiat currencies to drop, as there would be less demand for them. This could lead to inflation, as the supply of fiat currency would increase while the demand remained the same.

In addition, if Bitcoin becomes more popular, it could start to compete with traditional currencies as a means of exchange. This could lead to a decrease in the use of traditional currencies and an increase in the use of Bitcoin.

Finally, it is important to note that Bitcoin is still a very new technology. It is not yet clear how it will impact the world’s economy in the long term. There is a possibility that it could have some positive impacts, but there is also a chance it could have negative impacts.

Only time will tell how Bitcoin trading will impact the world’s economy. In the meantime, it is important to be aware of the potential risks and rewards of investing in Bitcoin.

How can bitcoin trading affect the World’s economy?

Bitcoin trading can have a positive or negative impact on the world economy. For example, if Bitcoin is used to purchase goods and services, it can help stimulate the economy. On the other hand, if Bitcoin is used for illegal purposes, then it could harm the economy.

Bitcoin trading can also affect the price of other assets. For example, if the price of Bitcoin goes up, people may start selling their stocks and investing in Bitcoin. It could lead to a stock market crash.

Conclusion

Bitcoin trading is a new technology that has the potential to have both positive and negative impacts on the world economy. For example, if Bitcoin is used to purchase goods and services, it can help stimulate the economy.

On the other hand, if Bitcoin is used for illegal purposes, it could harm the economy. In addition, Bitcoin trading can also affect the price of other assets.

For example, if the price of Bitcoin goes up, people may start selling their stocks and investing in Bitcoin. It could lead to a stock market crash.

Overall, Bitcoin trading can positively and negatively affect the world economy. It all depends on how it is used.

Have any thoughts on this? Let us know down below in the comments or carry the discussion over to our Twitter or Facebook.

Editors’ Recommendations:

- Five reasons to invest in crypto

- Practical tips to trade bitcoin

- How to make money by trading bitcoin

- New age bitcoin trading – everything you need to know