Android

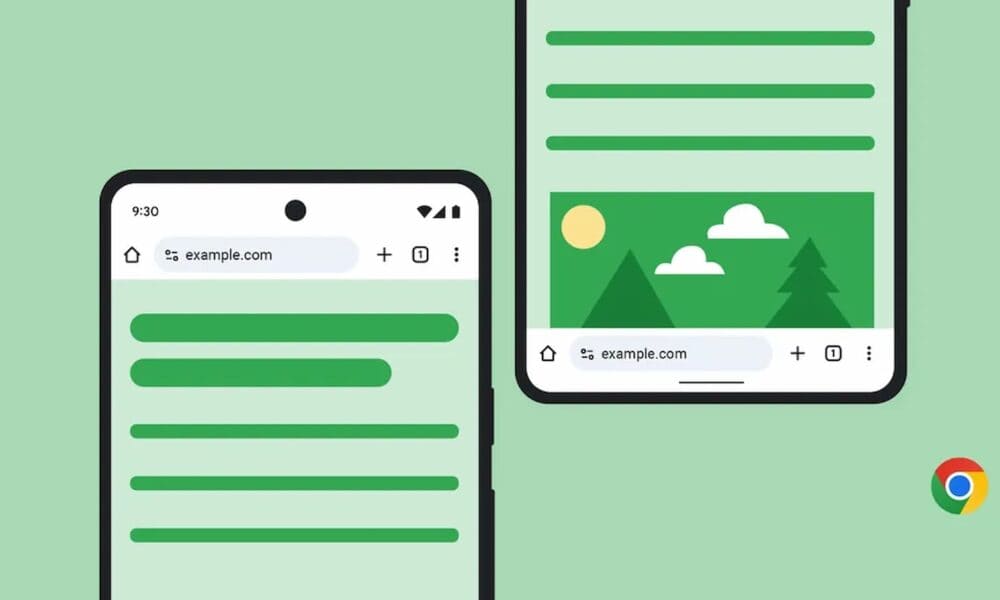

Chrome update puts URL bar where your thumbs actually are

Wave goodbye to awkward thumb stretches! Chrome for Android is embracing the future with a bottom address bar, making navigation a breeze on larger screens.

-

Android

/ 1 month agoInstagram was secretly killing your Android battery—here’s the fix

Instagram's latest update is here to rescue your battery life. Say goodbye to power-hungry scrolling and hello to a more efficient...

-

Android

/ 2 months agoHonor 400-series drops with ridiculous AI camera prowess

Honor's new 400 Pro 5G and 400 5G get AI-powered 200MP Super Zoom cameras, 5G, and long-lasting 5300mAh batteries.

-

Android

/ 2 months agoAndroid 16’s desktop mode is here to murder your laptop

Google's new Desktop Mode for Android is making waves, turning phones into full-fledged computers and shaking up the tech industry.

-

Android

/ 4 months agoThe new Pixel 9A makes expensive phones look kind of dumb

Google has announced its latest "affordable" Pixel, the Pixel 9A, which features a sleek design, high-end features such as a 120Hz...

-

Android

/ 4 months agoGoogle’s Find My Device will now let you share location with friends

Device tracking and location-sharing are now under the same roof on Android.

-

Android

/ 4 months agoLive Updates come to Google Maps in the latest Android 16 Beta

Google Maps will show important stuff, like your ETA and time to next turn, in its iconic green background.

-

Android

/ 4 months agoSamsung debuts “Project Moohan” Android XR headset at MWC

Once again, Samsung delivers a closer look at its Vision Pro competitor—this time at MWC. However, pricing and availability details are...

-

Android

/ 5 months agoApple TV+ streaming app is now available on Android

You can now directly subscribe to Apple TV+ from your Android smartphones and tablets through Google Play without needing an Apple...

-

Android

/ 6 months agoAndroid 16’s first beta release starts rolling out

Android 16's final release is expected later this year.

-

Android

/ 6 months agoFresh leak reveals Galaxy S25 Edge’s charging speed

A 25W changing support, paired with the Samsung’s thin phone’s presumably small battery, is a disaster waiting to happen.

-

Android

/ 6 months agoSamsung officially showcases its slim flagship: the Galaxy S25 Edge

Samsung briefly showcases the thinner Galaxy S25 at the end of the event and nothing more.

-

Android

/ 6 months agoSamsung Galaxy S25 Series debuts with a strong AI push

Pre-orders are now live, and general availability begins on February 7.

-

Android

/ 6 months agoCircle to Search arrives for Nothing Phones with Android 15 update

Circle to Search feature is now available for some Nothing phones with the Nothing OS 3.0 update.

-

Android

/ 7 months agoAndroid 16 to bring low-light photography improvements

The new Night Mode Indicator API will be a part of Android 16’s camera app extension, designed to optimize your snaps...

-

Android

/ 7 months agoDecember 2024 Google Pixel Feature Drop is here

The update focuses more on new features than on boring bug fixes.

-

Android

/ 7 months agoNothing could release Phone (3) and two other phones in 2025

Nothing Phone (3) is coming.

-

Android

/ 8 months agoGoogle rolls out first Android 16 Developer Preview for Pixel devices

Google Pixel 6 and above are eligible for the Android 16 update.

-

Android

/ 8 months agoYour Google Pixel will now warn you about scams in real-time

It only works with Tensor-powered Pixel phones.

-

Android

/ 8 months agoGoogle is bringing big Android Auto updates to Ford EVs

It offers real-time battery level estimations and which suggests minimum required charge to reach the destination.