How-To

How to file your 2020 taxes online for free

*with one proviso, you have to have earned under $72k.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

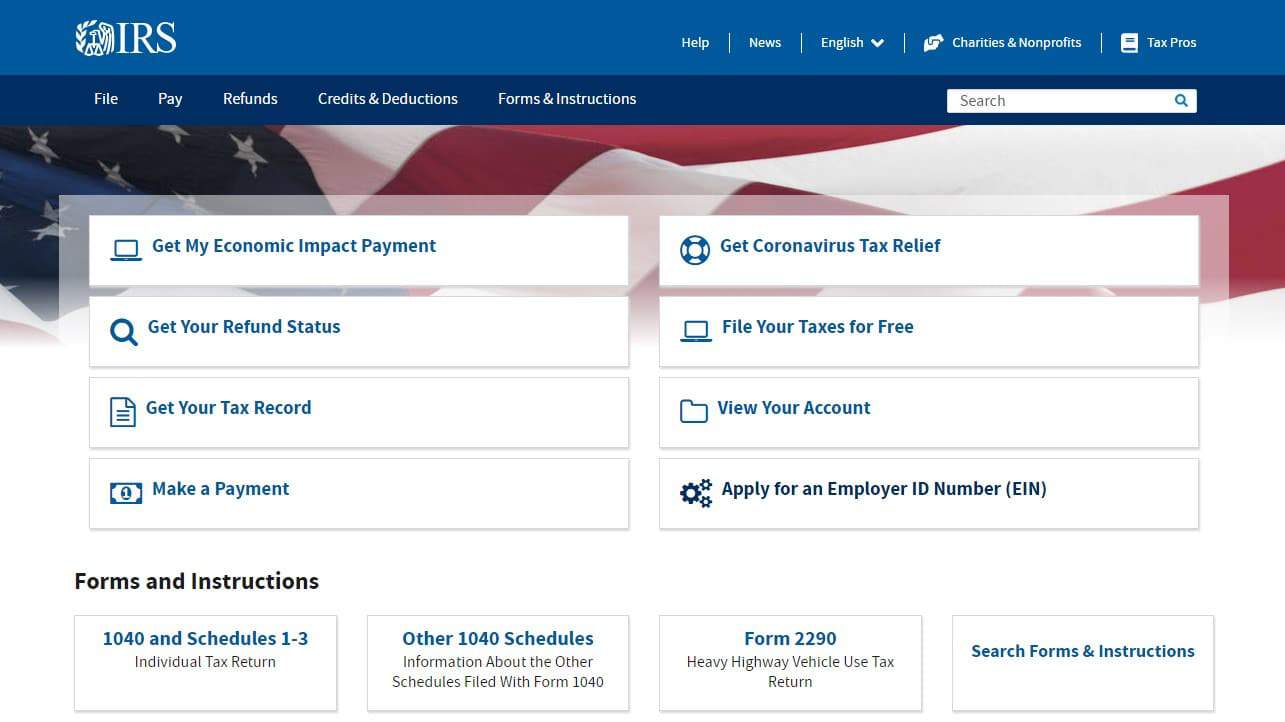

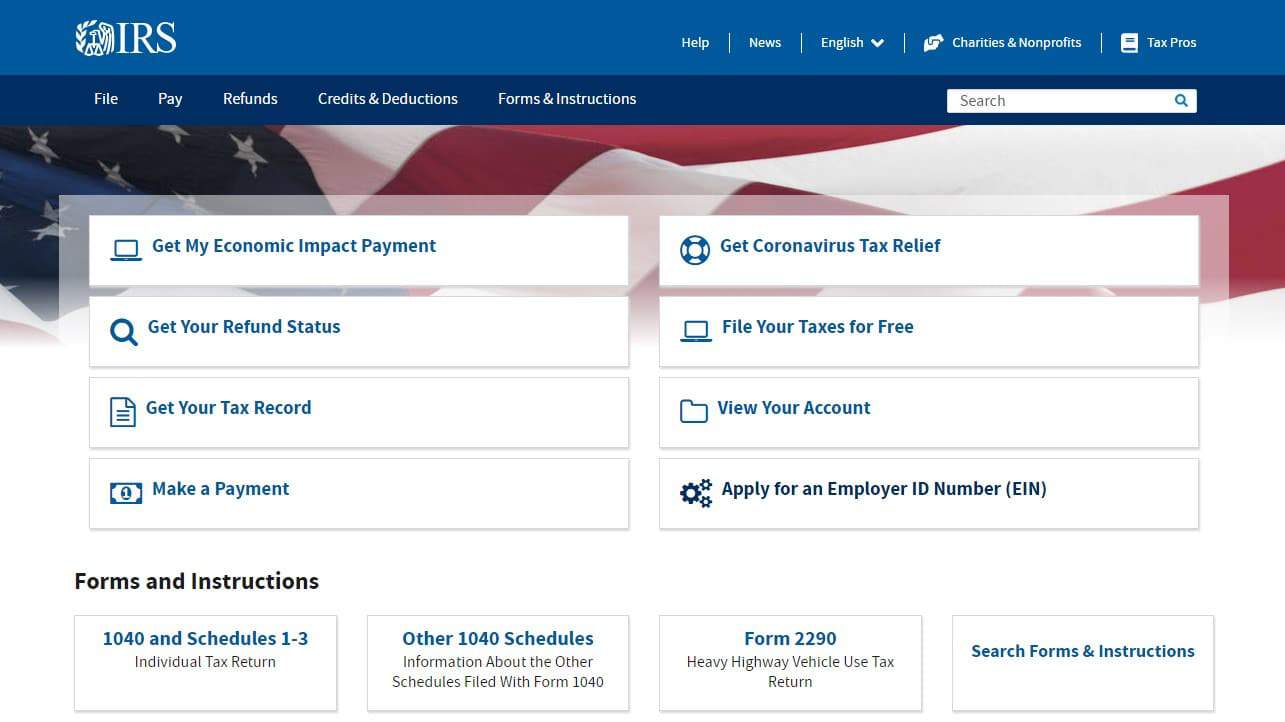

With all of the money that the big tax preparers spend on marketing, you might not know that you can still file for free, often directly with the IRS. This year, tax season is slightly delayed by the pandemic, with many preparers only opening on February 12.

Last year, we all got a delayed end of tax season, due to the early stages of the pandemic. It doesn’t appear that this year will get the same reprieve, so federal tax returns need to be filed by their usual date, April 15.

The IRS does note that if you file a paper tax return, you might get a delay in processing, as the coronavirus mitigations have meant a limit to in-person staffing. Maybe this year is the time to learn how to file electronically, if you’re able to.

Things to know before we continue

Did you get an Economic Impact Payment, aka Stimulus Payment last year? You’ll be glad to know that the IRS won’t count that as taxable income.

If you’re new to working from home, or haven’t filed taxes while working from home for some years, you’ll need to know one important thing. While the Tax Cuts and Jobs Act (TCJA) that was passed in 2017 simplified deductions, it also removed the option to deduct any job-related expenses (like a home office), until 2025. This doesn’t affect self-employment, only those who are working for an employer from their home.

If you want more information on this, or any other tax quirks that may affect you, head on over to the IRS Tax Tips page, or consult a licenced accountant.

How do I file my taxes online?

Be aware that if you are using the Free File Fillable Forms, you won’t get guided preparations or easy calculations. You’ll also have to file your state taxes from the website run by your state. You can still file for free electronically with other services, like Credit Karma Tax.

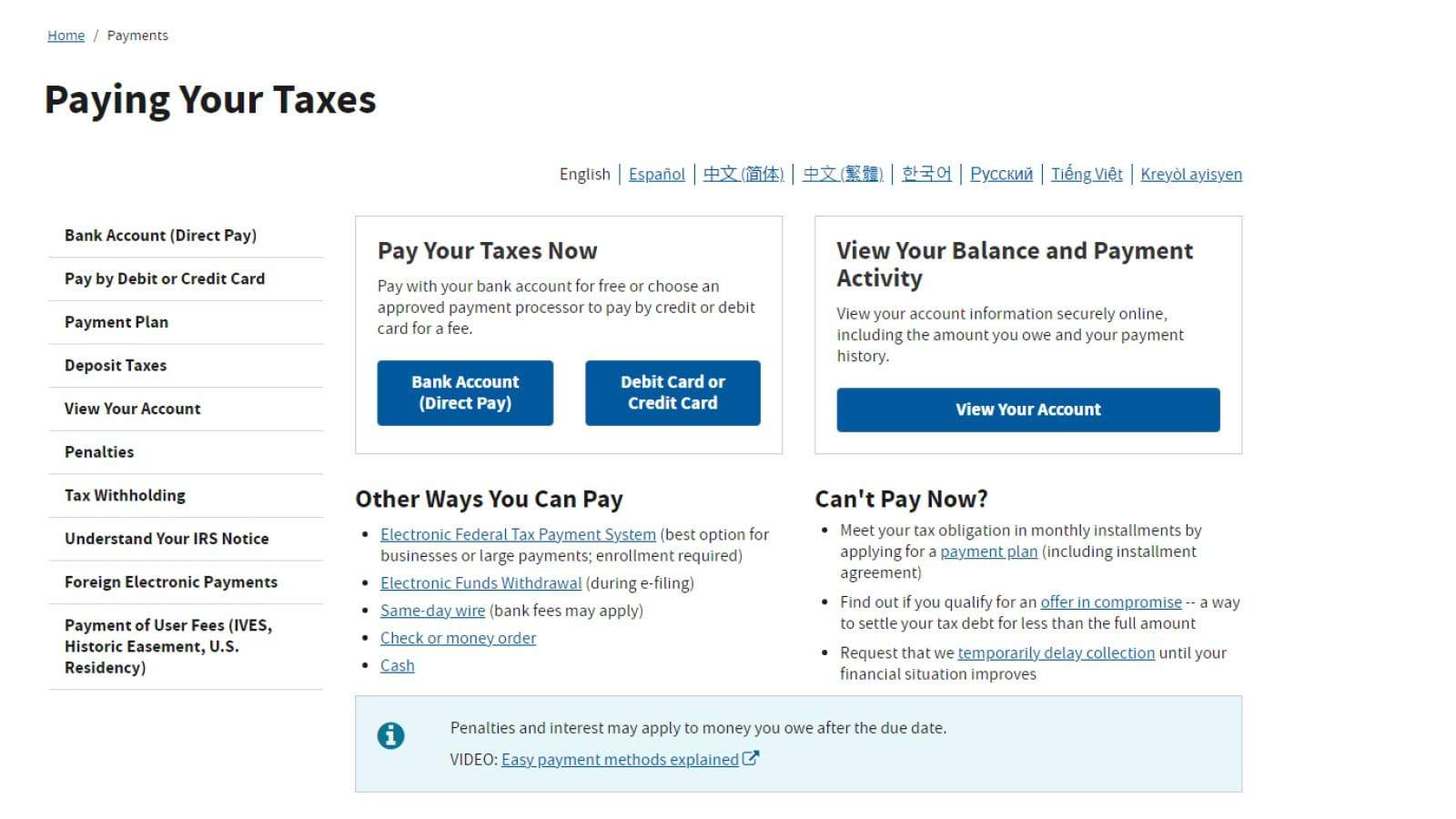

How to pay your taxes online

The IRS gives you multiple choices on how to actually pay your taxes, assuming that you aren’t expecting a refund. Tax preparation software or tax professionals will give you the option for Electronic Funds Withdrawal at the same time you file. That pulls directly from your nominated bank account, so make sure you have enough of a balance beforehand.

If you prefer, you can use IRS Direct Pay, which also pulls from either a savings or checking account; or you can use a credit or debit card (with a nominal fee attached).

How does the IRS get my refund back to me?

Once you’ve filed, you can check the status of your refund online. That tool should show e-file cases within 24 hours, or paper tax returns within four weeks. In most cases, your refund will get electronically sent into the bank account you have on file with either the IRS or your tax preparer. If you’re one of the one in five taxpayers that prefer paper checks, you’ll have to wait a little bit longer for the IRS to process your return and mail a check.

You can also use your return to purchase U.S. Savings Bonds, which have a 30-year maturity with a guaranteed interest rate. You can purchase up to $5,000 a year.

What do you think? Plan on filing your own taxes this year? Let us know down below in the comments or carry the discussion over to our Twitter or Facebook.

Editors’ Recommendations:

- Use this tool to get an estimation of your next (possible) stimulus check

- The new COVID-19 stimulus bill sneaks in felony charges and jail time for illegal streaming

- PwC apparently wants to do your kids’ Bitcoin taxes

- 4 things you should know about crypto taxes before the April 15th deadline