How-To

How to spot a fake social media profile before you get scammed

Arm yourself with the knowledge to identify fake profiles on social media and dating platforms. This isn't just a precaution—it's your shield against deception.

-

Apps

/ 4 weeks agoHow to enable replays on your Clubhouse chats

Want to save your recordings or make them available to others? Now you can. Here's how.

-

How-To

/ 4 weeks agoCan you buy a replacement controller for the Oculus Quest 2?

If you accidentally break an Oculus Quest 2 controller, can you buy another one?

-

How-To

/ 1 month agoHow to prevent MacBook’s two-finger swipe from ruining your day

Wave goodbye to accidental swipes! Transform your MacBook experience by navigating to System Settings > Trackpad > More Gestures and disabling...

-

Facebook

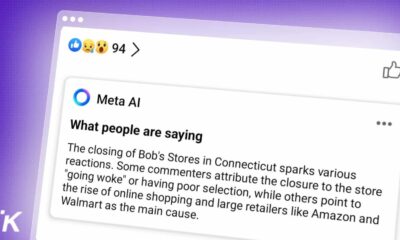

/ 1 month agoHow to disable Facebook’s AI comment summaries

Meta's AI update sparks backlash as users demand a mute button. Learn how to disable comment summaries and opt out of...

-

Apple

/ 2 months agoHow to claim your share of Apple’s $95 million Siri spying settlement

Apple's $95 million settlement is a wake-up call for privacy in tech. Siri's secret recordings have sparked a push for tighter...

-

Audio

/ 2 months agoCan you use a USB microphone with Xbox?

Xbox doesn't officially support USB microphones, but we've found a clever workaround.

-

Apple

/ 2 months agoHow to update your iPhone

Update your iPhone to get the latest operating system updates, now on iOS 17.

-

How-To

/ 3 months agoThe cheapest way to get Xbox Game Pass Ultimate

You can redeem Microsoft Rewards points, convert Game Pass Core to Ultimate, or share a subscription.

-

How-To

/ 3 months agoHow to mute words and phrases on Twitter (Now X)

It's actually quite simple once you know where to look.

-

How-To

/ 3 months agoHow to block words, phrases, and emojis on Instagram

Instagram users can block unwanted words and phrases on the platform through the Hidden Words feature, which can be accessed in...

-

How-To

/ 4 months agoHow to delete your 23andMe data before it’s too late

23andMe filed for Chapter 11 bankruptcy, Customers urged to delete their data due to a recent massive data breach affecting nearly...

-

Google

/ 4 months agoHow to use Google Gemini from your iPhone lock screen

Google has released an update to the Gemini app that allows users to chat with the voice assistant without unlocking their...

-

How-To

/ 4 months agoHow to save Wi-Fi passwords on Xbox Series X

You don't have to keep manually adding passwords every now and then, just follow these steps.

-

How-To

/ 5 months agoYouTube Guest account disapears – here’s how to keep watching

YouTube's guest account feature is no longer available on TV apps, but a workaround is available, allowing users to continue using...

-

-

How-To

/ 6 months agoHow to escape the group text nightmare on iPhone and Android

Escape the group chat hell: your ultimate guide to digital peace and quiet.

-

ChatGPT

/ 7 months agoChatGPT’s search engine is free for everyone – here’s how to use it

ChatGPT's new web search feature is now free for all users, allowing real-time internet crawling. This update challenges Google's search dominance....

-

AI

/ 7 months agoHow to supercharge your iPhone with ChatGPT’s new search feature

ChatGPT's latest update introduces a powerful search feature that allows users to access real-time information from the web, providing more accurate...

-

Gaming

/ 8 months agoWhy does my Xbox keep turning off?

If your console keeps turning off, it's time for some troubleshooting.