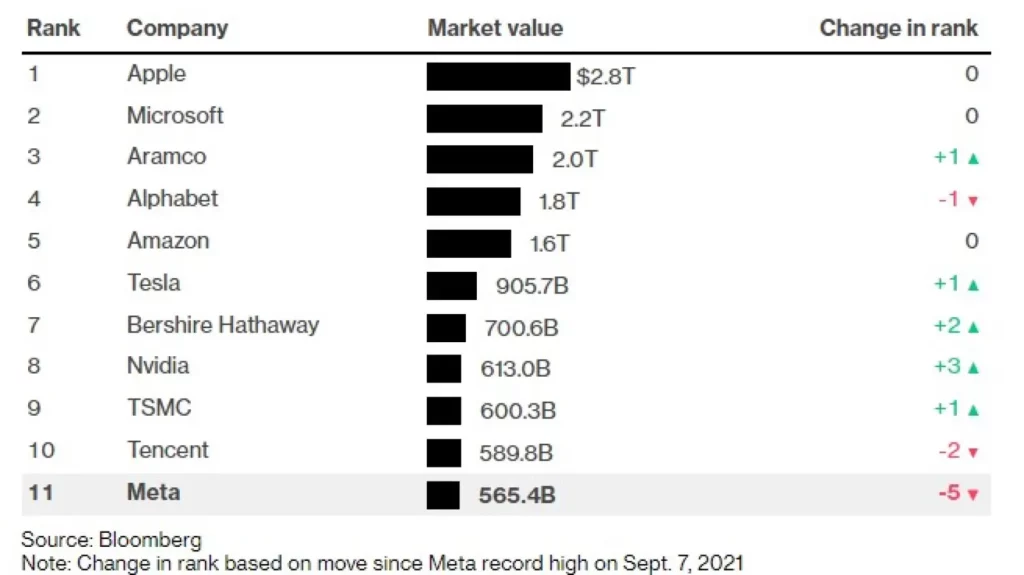

Meta spirals from the top-10 list of most valuable companies

We could have told you it was worthless years ago.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

Meta, previously Facebook, is no longer among the top ten most valuable global companies. That’s after a 45-percent tumble in stock price from its peak in September when Meta was a trillion-dollar company.

The stock slump happened after the company rebranded to Meta and laid claim to the future of the metaverse. And it is a slump. The overall market was up massively in 2021, with the S&P 500 benchmark index up 26.9-percent in that time.

The increase in index performance was primarily driven by large-cap tech stocks like Apple, Microsoft, and Alphabet, the so-called FAANG companies of which Facebook is one.

It’s perhaps not too hard to see why Meta’s stock has plummeted. It’s business as usual for the leadership over at Meta.

The incoming CTO took time during an interview to run damage prevention, blaming individual users for the rampant misinformation on Facebook. Maybe that’s why it also tried to blame its Oversight Board for the slow pace of improvements.

The rebranding to Meta also coincided with Apple introducing new ad tracking controls, which have hurt Facebook’s advertising income.

In 2022 alone, that change will rip $10 billion out of Facebook’s income stream. New data regulations in the EU also resulted in Meta throwing empty threats of leaving Europe at legislators.

Have any thoughts on this? Let us know down below in the comments or carry the discussion over to our Twitter or Facebook.

Editors’ Recommendations:

- Meta has to pay $90 million for tracking users even after they logged off

- Snapchat now offers real-time location tracking so your friends can watch your back

- Twitter is finally giving people a better way to sort DMs

- Instagram now lets you send private Story likes that don’t clog up your DMs